Stamp Duty Holiday – Not just an under £500k thing!

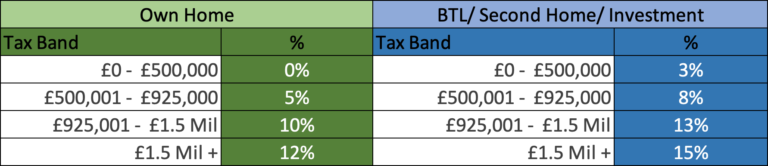

As you may have already heard, the government has temporarily increased the stamp duty threshold to £500,000 for property purchases in England and Northern Ireland, until 31 March 2021. In other words, there will be no stamp duty charged on properties costing up to £500,000.

Some good news – statistics show that the average stamp duty bill will fall by £4,500 and nearly 90% of people will benefit by paying no stamp duty at all as a result of the stamp duty holiday. This holiday is not just applicable for purchases under £500,000. If you, for example, purchase a property for £600,000 you will only pay stamp duty on the portion above £500,000, so in this scenario £100,000.

Not only that, but those looking to purchase a buy-to-let or second home/investment property will also benefit from this payment holiday. Only 3% stamp duty is due for properties up to £500,000 (previously £125,000). So with depressed price levels vs last year, record-low borrowing costs, ability to use retirement income and a stamp duty holiday, has there been a better time for a long term property investment with a mortgage?

We have 2 in-house brokers who together with your financial adviser will help you decide if this is a good option for you. Contact us today for an obligation-free quote.

This is only for purchases that complete before 31st March 2021.

The full table is shown below.

Ascot Wealth Management Limited is authorised and regulated by the Financial Conduct Authority reference 551744. Our registered office: Scotch Corner, London Road, Sunningdale, Ascot, Berkshire, SL5 0ER. Registered in England No. 7428363. www.old.ascotwm.com Unless otherwise stated, the information in this document was valid on 3rd February 2017. Not all the services and investments described are regulated by the Financial Conduct Authority (FCA). Tax, trust and company administration services are not authorised and regulated by the Financial Conduct Authority. The services described may not be suitable for all and you should seek appropriate advice. This document is not intended as an offer or solicitation for the purpose or sale of any financial instrument by Ascot Wealth Management Limited. The information and opinions expressed herein are considered valid at publication, but are subject to change without notice and their accuracy and completeness cannot be guaranteed. No part of this document may be reproduced in any manner without prior permission. © 2017 Ascot Wealth Management Ltd. Please note: This website uses cookies. To continue to use this website, you are giving consent to cookies being used.