AWM Performance Monitor – August 2020

Note From The Managing Director.

The advisory portfolios had a strong August, all posting positive numbers in what was a muddling month for asset classes overall. Mid-month there was a lot to digest for investors with I would say the first signs of volatility coming back into the various markets for bonds, equities and commodities. This has split into September but comments will stay focused on this month’s overview.

The biggest battle we see currently is in the direction of inflation with mid-month deferrals of the second US stimulus bill looking like being the end of September at the earliest. This meant sell-offs in asset classes such as gold and inflation-protected bonds, Gold had reached a peak close to 2100 but has dropped and seems to be trading in a range of around 1950. We have held our overweight position as we still sit on the inflation risk fence that low long term inflation. I think this theme was somewhat reflected at month-end and I have a deeper view that as much as some sales chains, such as our own with video meetings have been officiated I see short to medium term issues with the supply of goods and this will likely lead to inflationary pressure. Just this week in the FT (Financial Times) there was a good example of this applied to a rabbit purchase. The journalist’s pet rabbit had died during the lockdown and she set out to replace it but could not find one due to the sudden demand for small pets. She ended up paying triple the standard amount to replace her furry friend. This theme resonated with me and this is why we will keep our gold overweight for the time being. There was continued out-performance in many sectors for actively managed funds and this is something adopted into thinking in the Cape Berkshire equivalents. Early October will see the realignment of these AWM portfolios to their Cape Berkshire led equivalents, performance-wise there has not been too much difference Q3 to this point.

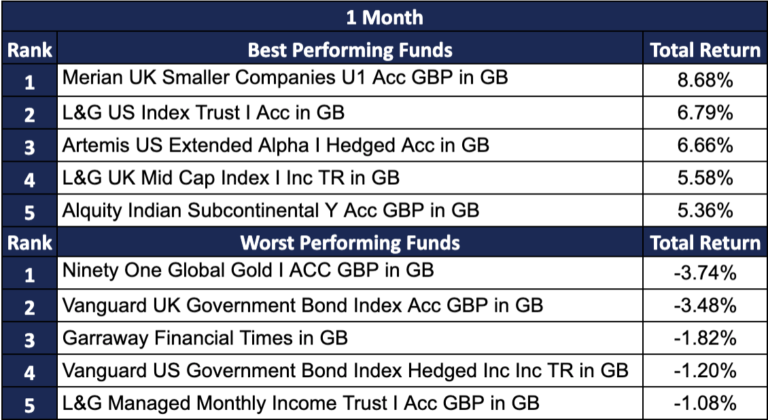

Positives on the month were the small and midcap UK positions we hold as part of our UK allocation. The FTSE had a torrid month finishing sub 6000, at a time the Nasdaq the US tech index was running away higher. The service-based nature of the UK economy has hurt our domestic recovery but there must come a point where there are some attractive fund or investment trust-based value plays. Either way, the Merion UK Smaller Companies fund up 6.68% was a real star performer on the month. Of other note was the resignation after a long period of governance of Prime Minister Abe in Japan which we will see the fallout in the coming months. We remain underweight Japan vs benchmark, not with mass negativity but as I always remind clients the overweight’s must be funded from somewhere. Of note, we again saw a good recovery of the Indian Alquity fund where like the UK mid and small caps outperformed.

Our next note will be our quarterly update where we will look further to BREXIT and the pending US election in quarter 4. Enjoy the month.

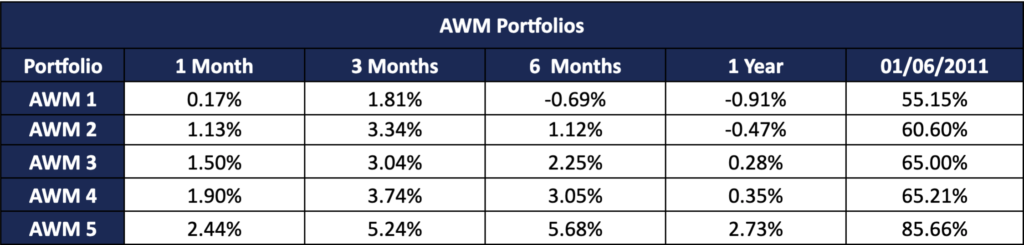

AWM Portfolio Performance

These tables simply indicate AWM’s portfolio’s over the stated time periods up to 31/08/2020.

Market Update

Yet another very encouraging month all portfolios showing a solid performance (on average +1.43% over the month). This is greater than both the FTSE100 (returning +1.12%) and the UK Government Gilt sector (returning -3.60%). As these two benchmarks are seen as opposite ends of the risk spectrum, this gives evidence that the AWM portfolios have generated considerable risk-adjusted returns for the month.

Over a 3 month period, the advisory portfolios have returned between 5.58% and 7.77% (mean of 3.64%), largely outperforming their FTSE UK Private Investor benchmark counterparts. As I author this note, since the COVID-related portfolio lows of 23rd March, the portfolios have returned between 12.15% (AWM1) and 31.29%. This strong continuing performance beyond the initial recovery maintains our confidence in the management of the portfolios.

Click through to the performance graphs for longer-term overviews and versus world indices.

Best and Worst Performing Funds

This table simply indicates a portion of the AWM’s chosen invested funds, which are either the best performing or worst performing, over the stated time periods up to 31/08/2020.

This information is correct and up to date as of 10/09/2020.

This Performance Monitor has been created from multiple sources as well as our own views and this should not be taken as investment advice. If you require financial advice then please contact us by email or phone so that you can speak to a qualified financial adviser. Any information provided/gathered will be subject to the General Data Protection Regulation (GDPR). You may be assured that we and any company associated with Ascot Wealth Management will treat all personal data and sensitive personal data and will not process it other than for a legitimate purpose.

Ascot Wealth Management Limited is authorised and regulated by the Financial Conduct Authority reference 551744. Our registered office: Scotch Corner, London Road, Sunningdale, Ascot, Berkshire, SL5 0ER. Registered in England No. 7428363. www.old.ascotwm.com Unless otherwise stated, the information in this document was valid on 3rd February 2017. Not all the services and investments described are regulated by the Financial Conduct Authority (FCA). Tax, trust and company administration services are not authorised and regulated by the Financial Conduct Authority. The services described may not be suitable for all and you should seek appropriate advice. This document is not intended as an offer or solicitation for the purpose or sale of any financial instrument by Ascot Wealth Management Limited. The information and opinions expressed herein are considered valid at publication, but are subject to change without notice and their accuracy and completeness cannot be guaranteed. No part of this document may be reproduced in any manner without prior permission. © 2017 Ascot Wealth Management Ltd. Please note: This website uses cookies. To continue to use this website, you are giving consent to cookies being used.