- 01344 851250

Facebook

Twitter

Instagram

Linkedin

Stamp Duty Land Tax

Stamp Duty is a tax you pay if you buy a residential property or a piece of land in England or Northern Ireland over a certain price. The price is set by the government.

The amount you are due to pay depends on when you bought the property and how much you paid for it. Stamp Duty Land Tax (SDLT) only applies to properties over a certain value.

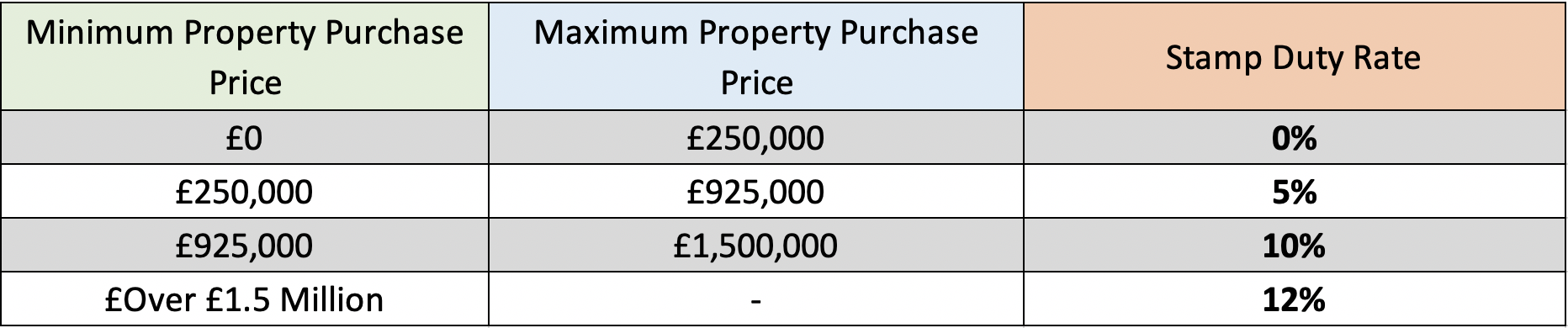

The Chancellor of the Exchequer, Kwasi Kwarteng, announced a change to Stamp Duty rates on 23rd September 2022. The starting threshold for paying Stamp Duty has been increased from £125,000 to £250,000. Homebuyers will not have to pay stamp duty on the first £250,000 of any property purchase. The new tax tiers for amounts above the threshold will be as follows.

Stamp Duty Rates

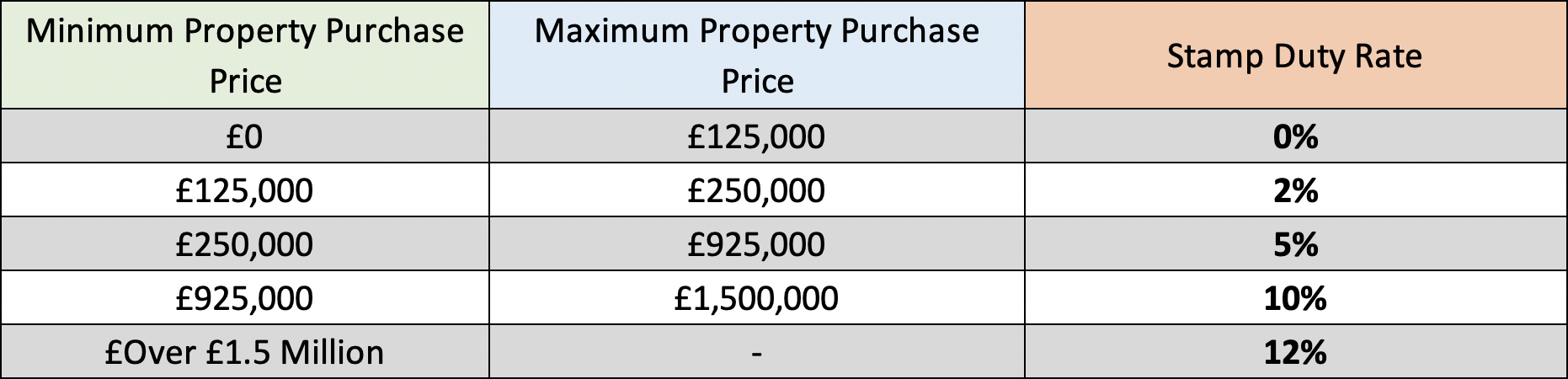

Old Stamp Duty Rates

First-Time Buyers

This is a person who is purchasing their only or main residence and has never owned a property in the UK or abroad.

First-time buyers will pay no Stamp Duty on properties up to £425,000. For properties up to £625,000 they will pay a discounted rate. They will pay no stamp duty up to £425,000 and then 5% Stamp Duty on the amount above £425,000 up to £625,000.

For properties over £625,000 the first-time buyer would no longer be classed as a first time buyer and would have to pay the standard rates of Stamp Duty. They will not qualify for first-time buyer’s relief.

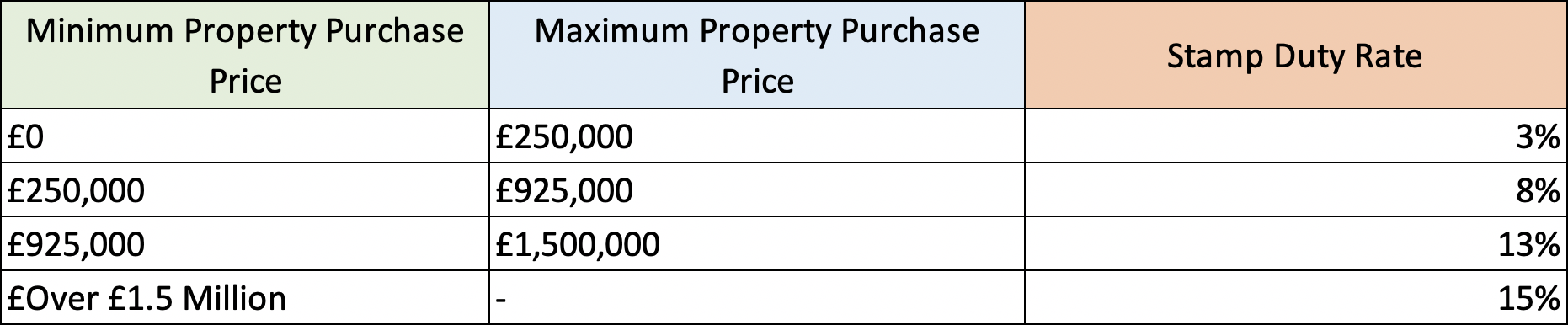

Stamp Duty On Second Home

Those buying an additional property or a second home will pay an extra 3% in Stamp Duty on top of the standard rates.

Written by: Nwabisa Janda

03 October 2022

Contact Us

Facebook

Twitter

Instagram

Linkedin

Ascot Wealth Management Limited is authorised and regulated by the Financial Conduct Authority reference 551744. Our registered office: Scotch Corner, London Road, Sunningdale, Ascot, Berkshire, SL5 0ER. Registered in England No. 7428363. www.old.ascotwm.com Unless otherwise stated, the information in this document was valid on 3rd February 2017. Not all the services and investments described are regulated by the Financial Conduct Authority (FCA). Tax, trust and company administration services are not authorised and regulated by the Financial Conduct Authority. The services described may not be suitable for all and you should seek appropriate advice. This document is not intended as an offer or solicitation for the purpose or sale of any financial instrument by Ascot Wealth Management Limited. The information and opinions expressed herein are considered valid at publication, but are subject to change without notice and their accuracy and completeness cannot be guaranteed. No part of this document may be reproduced in any manner without prior permission. © 2017 Ascot Wealth Management Ltd. Please note: This website uses cookies. To continue to use this website, you are giving consent to cookies being used.