Facebook

Twitter

Instagram

Linkedin

Cash Savings

Information accurate as of 21/07/2022

With the Bank of England base rate at 1.25% and UK inflation hitting 9.4%, it is important to ensure you’re reviewing cash savings to get the best rate possible. To mitigate the risk of losing the buying power of your savings this blog will introduce some of the market leading, Financial Services Compensation Scheme (FSCS) protected accounts available to savers.

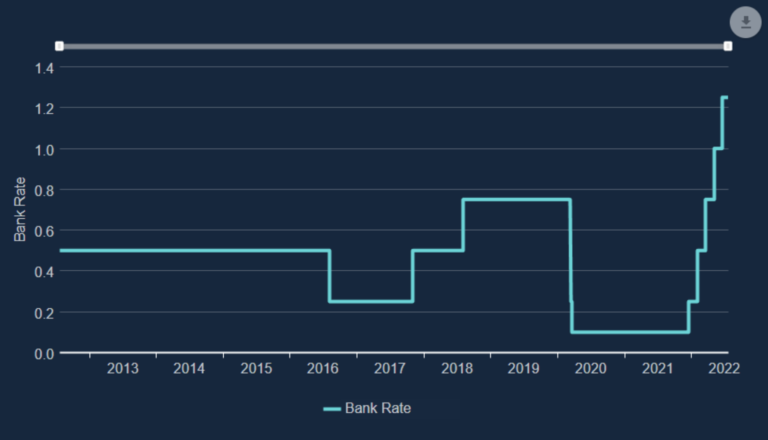

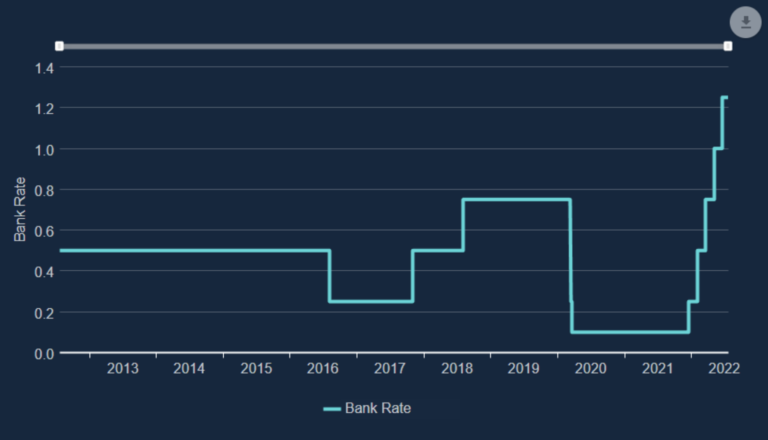

The context of interest rates rising is in response to roaring inflation. The snippet below from the Bank of England illustrates how rates have changed in the last ten years.

Source: Bank of England

We have another rate review from the Monetary Policy Committee (MPC) on the 4th August, with analysts suggesting we could see rates hike to 1.75%. Whilst this isn’t certain, financial markets have set a 94% probability we’ll see the 50bps rise.

Given we have frequent rate reviews ahead, it may be sensible for savings to consider a range of fixed and variable term savings accounts to hedge rates going even further. Some analysts predict we could hit close to 3% in the next 18 months, dictating a flexible savings vehicle would suit a cautious saver.

NS&I

Premium Bonds from National Savings & Investments have long been a popular choice for savings. The possibility of winning big motivates savers, so it feels like a safe ‘chance’ for large prize winnings. Importantly, money with NS&I is 100% protected from the Treasury, meaning you can ignore the FSCS rules and safely house savings of £85,000+ in value.

At present the interest rate on premium bonds equates to a 1.40% annual prize fund rate, with all prizes being completely tax free. The maximum winnings are £1million with over 1.4mn winners in June 2022.

Outside of Premium Bonds NS&I aren’t very market competitive, offering a low 0.5% for their direct saver and 0.35% for their direct ISA. For fixed term, they offer an income bond for two years at 2.2%.

Easy Access Savings

As noted, many savers are opting for instant access to give flexibility for rate rises and access for the impending hikes in their cost of living. Interest rates are usually therefore lower than on fixed savings periods, but the flexibility benefits can outweigh this disadvantage. At present we’d advise on the following easy access savings accounts from the open market:

- Chase Bank – an app based bank offering 1.5% AER on savings with a minimum of £1 deployed. They also offer 1% cash bank on debit card spends and a 5% interest on purchase round ups, making them our top choice for flexible, tech savvy savers.

- Shawbrook Bank – Shawbrook are offering a higher interest rate at 1.52% but with a minimum of £1,000. Here access is flexible, but you can only withdraw in chunks of £500

- Al Rayan – A sharia account, offers 1.6% interest with flexible access for balances over £5,000. They allow instant access with no limits attached.

Fixed Term Savings

Instead of saving in variable rate accounts, savers have the option to fix for between 1 and 5 years plus. For a 1 year fixed we’ve found the best rate to be with My Community Bank, coming in at 2.76% per annum, with a minimum balance of £1,000. Second to this is the Woodland Saver from Gatehouse Bank at 2.75% or Kent Reliance at 2.71%.

For a two year fixed we have 3.1% at Gatehouse Bank, with five years rising to 3.45% from PCF Bank Limited. Given the difference between these shorter term and longer term accounts, we would advise on shorter term fixing to price in the probability rates will continue to rise for savers until the Bank of England is closer to its inflationary targets.

Cash ISAs

Cash ISAs have long been seen as lower yielding than savings, meaning advisers encourage investors to use their ISA allowance for stocks & shares, and keep emergency cash in savings accounts. We continue to see this theme today, with the top immediate access cash ISA coming in at 1.5% interest from Newcastle Building Society, lower than that of Shawbrook instant access.

Alternatively fixed rate ISAs for three years will offer 2.75% at Aldermore, or 2.56% from Virgin Money for two years fixed. The two year fixed offerings sit over 0.5% lower than the fixed term non-ISA savings.

Of course cash ISAs benefit from all interest being tax free, but savers should bear in mind their personal savings allowance. For basic rate tax payers this is £1,000 per annum, higher rate £500 and additional rate £0. This means a basic rate tax payer with a Chase Bank Account would have to have over £66,500 saved to breach the threshold. In the instance a zero risk, higher or additional rate taxpayer who wants this liquid, the NS&I options of Premium Bonds (capped at £50,000) or growth bonds become more plausible.

Concluding Points

Given the central banking intention towards decreasing inflation we expect to continue to see rate rises until we have signs headline inflation is falling. The Governor of the Bank of England isn’t ruling anything out; therefore we’d expect markets to be pricing in a certain level of rate rise from central banks over the coming years.

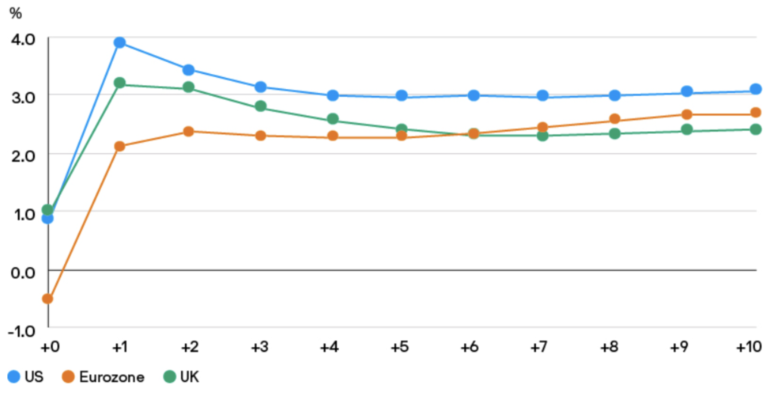

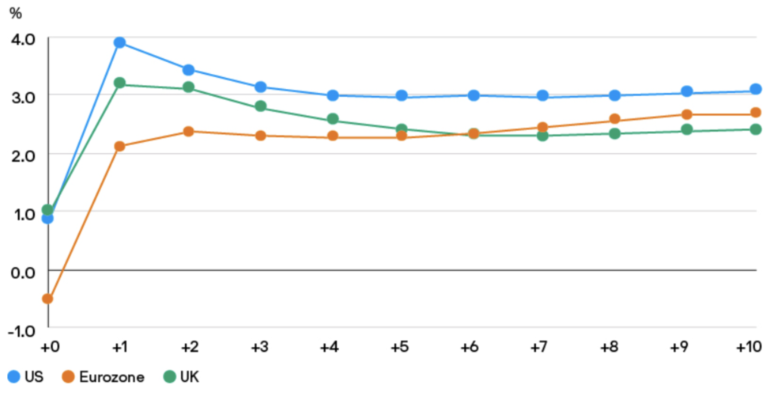

Below is a visual from the OIS forwards data sourced by JP Morgan. Here we can see the UK figures at the 3-4% point in the next twelve months, stabilising down to nearly 2% in ten years.

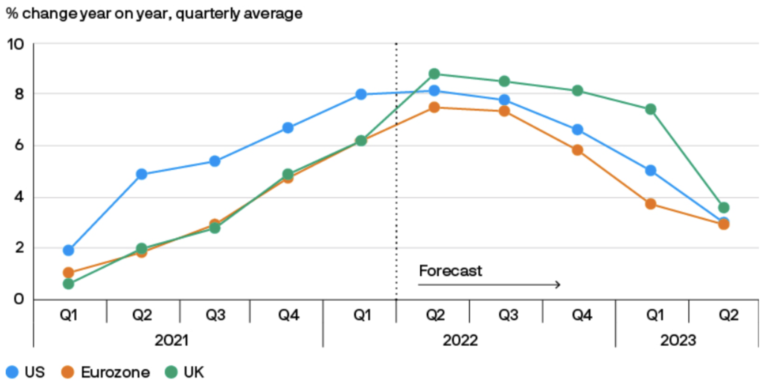

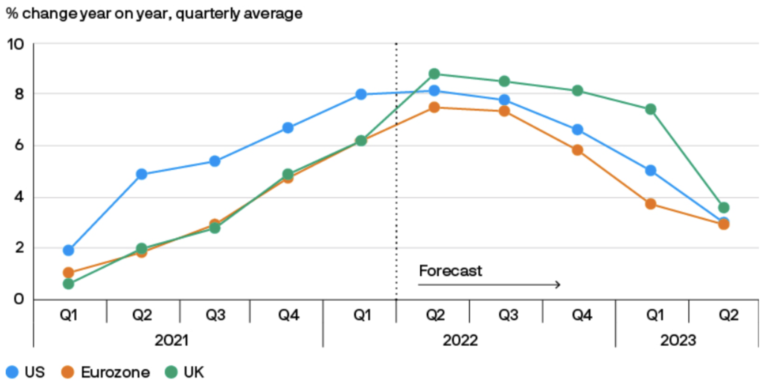

This is coupled with the view inflation will peak in Q3 of 2022, seeing a forecast fall from the fourth quarter of the year.

Given these challenges we would encourage savers to split savings between flexible and fixed rates, with Chase Bank and Gatehouse Bank offering strong product ranges. We’d also suggest maximising the premium bond threshold of £50,000 for zero risk investors or those concerned with FSCS thresholds for savings.

Please note that these types of products are not suitable for all clients and that this should not be taken as personal advice. All investments can go up and down in value and therefore you could get back less than you invest. Past performance is not a guide to the future.

Written by: Catriona McCarron

21 July 2022

Contact Us

Facebook

Twitter

Instagram

Linkedin

Ascot Wealth Management Limited is authorised and regulated by the Financial Conduct Authority reference 551744. Our registered office: Scotch Corner, London Road, Sunningdale, Ascot, Berkshire, SL5 0ER. Registered in England No. 7428363. www.old.ascotwm.com Unless otherwise stated, the information in this document was valid on 3rd February 2017. Not all the services and investments described are regulated by the Financial Conduct Authority (FCA). Tax, trust and company administration services are not authorised and regulated by the Financial Conduct Authority. The services described may not be suitable for all and you should seek appropriate advice. This document is not intended as an offer or solicitation for the purpose or sale of any financial instrument by Ascot Wealth Management Limited. The information and opinions expressed herein are considered valid at publication, but are subject to change without notice and their accuracy and completeness cannot be guaranteed. No part of this document may be reproduced in any manner without prior permission. © 2017 Ascot Wealth Management Ltd. Please note: This website uses cookies. To continue to use this website, you are giving consent to cookies being used.